The exuberance that gripped the art trade for the past two years has dissolved. Here’s how to get an edge in the buyer’s market.

Image: Village Green.

This article is part of the Artnet Intelligence Report Mid-Year Review 2023. Marking five years of our biannual Intelligence Reports, this inaugural half-year edition paints a data-driven picture of today’s art world, from the latest market results to the artists and artworks leading the conversation.

Auction houses want to start their sales with a bang. That’s why they select as the first lot a work they are virtually certain will fly. But at the beginning of one of Christie’s highest-profile sales of the major spring season in New York, only three bidders went after a blue porcelain head by Simone Leigh. A large sculpture had set a record for the celebrated American artist just a few days earlier. After a brief back-and-forth, bidding stopped in its tracks at $500,000, the high estimate. The room was immediately on edge.

That was the first of many surprises during the two-hour auction of Gerald Fineberg’s collection in May, which encapsulated this anxiety-filled, transitional art-market moment. While the sale wasn’t a bloodbath, even the most optimistic observers could no longer deny what it meant: The irrational exuberance that had gripped the market since COVID-19 struck was officially over. “Dealers have been saying for a year that there’s been a reset,” said art advisor Wendy Cromwell. “The auctions were just the public acknowledgement of that.”

Glenstone founders Mitchell Rales and Emily Wei Rales. Photo: Saul Loeb/AFP via Getty Images.

Periods of retrenchment or correction are tough, but for those who know what they are doing and have the cash to execute, they can also be great opportunities to build collections, and even entire museums. Just think of the late Eli Broad, who amassed the bulk of his collection in the 1990s, during the biggest art-market correction in recent history, and Glenstone founder Mitchell Rales, who did the same during the 2008 financial crisis. Of course, for the generation of market participants who have never experienced a downturn and came of age during the era of near-zero-percent interest rates, this moment—as the market’s ground shifts beneath their feet—is alarming. The data is sobering, too: Global auction sales from January 1 through May 20 declined about 14 percent, to just under $5 billion, compared with the same period a year ago. On a six-year basis, we are in between the $1.2 billion nadir of 2020 and last year’s peak of $5.8 billion. A new era has arrived. Welcome to the buyer’s market. At the spring sales, “I made out like a bandit,” said art advisor Ben Godsill.

A Correction in Real Time

A web of factors contributed to the dismal results of the Gerald Fineberg sale, which was estimated to bring in as much as $270 million and instead delivered $210 million (with many lower-value lots still to be sold). The details of the consignment were finalized early this year, in a considerably more robust market environment. The heirs of the late real-estate mogul, who died in December, refused the guarantees offered by the house and third parties, expecting a windfall but dramatically misreading the market. With no floor, prices seemed in freefall as lot after lot—by Gerhard Richter, Lee Krasner, Willem de Kooning, Christopher Wool, Lucio Fontana, Roy Lichtenstein—failed to reach their low estimates. Works by Mark Grotjahn, James Rosenquist, Louise Bourgeois, and Martin Kippenberger went unsold.

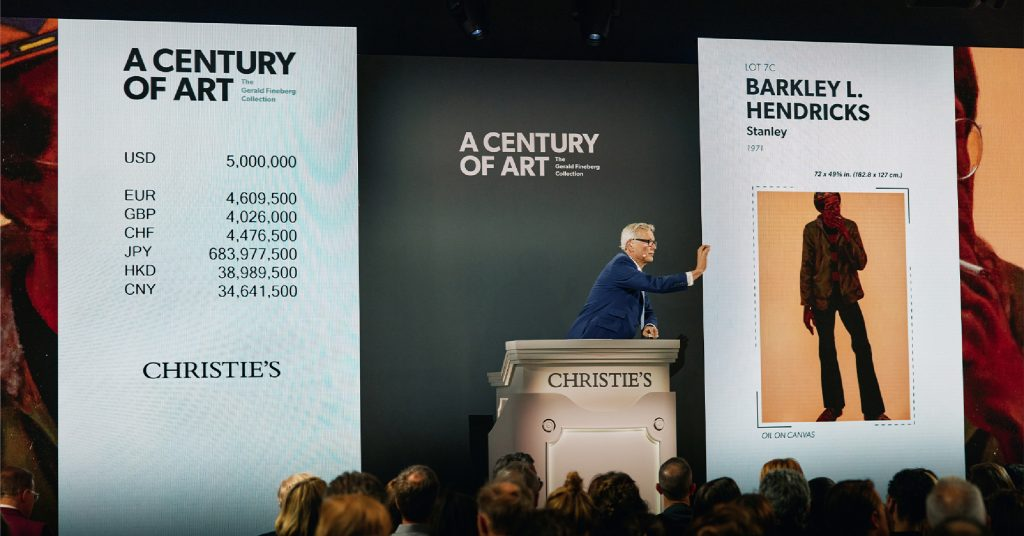

Christie’s Global President, Jussi Pylkkänen, sells Barkley L. Hendricks’s Stanley (1971) for a record price.

Courtesy of Christie’s Images Limited 2023.

“They left millions of dollars on the table,” said a New York-based art advisor whose client bought one of the top lots of the sale. Going into the auction, the client was ready to pay $8 million for the historic work, which carried an estimate of $5 million to $7 million. The final price, including fees, was $6.1 million. It was an auction record for the artist—but considerably less than the buyer had been willing to fork over. “My client is very happy,” the advisor said.

The Fine Art Group, which advises collectors internationally, ended up making several clients happy, too. A day before the Fineberg auction, Christie’s staffers began making panicked calls to clients asking for bids, any bids, sources say. The market was shifting in real time, and the estimates across New York’s semiannual auctions suddenly seemed too high. “We got phone calls saying, ‘The reserves are coming down,’” Philip Hoffman, the advisory’s CEO, recalled. “Suddenly you’ve got to rush to get your reviews done. You’ve got to check the condition. It’s bad marketing to do that.” But it wasn’t about marketing at that point. Christie’s was looking at the very real threat of the art market tanking.9 In the end, “our clients said, ‘At this price we are buying,’” Hoffman said.

Auctioneer Georgina Hilton sells the top lot of Christie’s 21st century evening sale, Jean-Michel Basquiat’s El Gran Espactaculo (1983).

Courtesy of Christie’s Images Limited 2023.

Galleries jumped on the discounted works by the artists they represent and support: David Zwirner bought an Alice Neel, Gagosian bought a Wool, Skarstedt a de Kooning, and Jeffrey Deitch a Basquiat, the Baer Faxt newsletter reported. Advisor Gabriela Palmieri won Ada With Pink Hat by Alex Katz on one bid, below the low estimate. The $1.1 million hammer price looked like a steal given the artist’s recent retrospective at the Guggenheim.

“It’s a reset, a recalibration,” said Jean-Paul Engelen, president of the Americas at Phillips, where the evening sale of 20th- and 21st-century art in New York totaled $69.5 million, a third of the $225 million tally in May 2022. The team withdrew some lots and lowered the reserves on many others to make things work, he noted. “Buyers are there, but money became more expensive. So people are more conscious of their spending.”

The New Normal

Sales at Sotheby’s (which generated $1.7 billion between January 1 and May 20), Christie’s ($1.7 billion), and Phillips ($254.9 million) have fallen 22 percent from the equivalent period in 2022. Of the top three national art markets, just one—China—increased its auction revenue. The U.S. remained the largest art market, with sales of $2.6 billion in the first five months of the year, but that total represents a 25 percent decline from the same period in 2022.

To be sure, some of this dip is because of a lack of supply. After top inventory piled up during the pandemic, recent seasons saw copious collections of unusually high quality, like those of divorcing couple Linda and Harry Macklowe, sibling art dealers Thomas and Doris Ammann, and the late arts patron Anne Bass. So far this year, the highest-end segment—works priced at $10 million or more—has contracted 51 percent, more than any other price bracket. (The majority of Microsoft founder Paul Allen’s estate was sold last fall, and so is not included in this report’s calculations.)

Pablo Picasso, Femme nue couchée jouant avec un chat (1964) sold below the low estimate at Sotheby’s. Courtesy of Sotheby’s © 2023

Estate of Pablo Picasso/Artists Rights Society (ARS).

Still, “it’s not all doom and gloom,” said one auction-house executive. “If you bring a special thing to the table, the collectors, the museums will show up. But it’s not like any Picasso is going to make $20 million.” Indeed, Picasso’s 1938 portrait of Marie-Thérèse Walter, estimated at $20 million to $30 million, failed to sell at Christie’s in May. A large-scale late Picasso, Femme nue couchée jouant avec un chat (1964), hammered below the low estimate of $20 million at Sotheby’s.

“When the market was frothier, people were buying just the name,” said Miami-based advisor Karen Boyer. “And now people are looking at the quality.”

But it’s not just supply—demand is also shifting. This is especially evident in the once white-hot ultra-contemporary segment, which declined 26 percent compared with 2022. Consider Louise Bonnet, whose Figure With Tablecloth (2020) failed to sell at Sotheby’s. Its estimate was $600,000 to $800,000, in line with last year’s breakout results for the fashionable, Surrealist-inspired painter. Two other works by the artist, each estimated $300,000 to $500,000 at Christie’s and Phillips, did sell, but for around $400,000.

What Changed?

It seems that the broader economic volatility finally caught up with the art market, which usually lags other indicators by at least six months. One challenge looming large: Money is not as cheap as it used to be. When hedge-fund managers discovered the art market, at the turn of the 21st century, they introduced and popularized various financial mechanisms to take advantage of the genteel, opaque trade. They loved 1031 like-kind exchanges, which enabled a buyer to use the proceeds from the sale of one artwork to purchase another in short order, deferring capital gains tax in the process. So prevalent was the use of the tax loophole that when the Trump Administration removed art from the list of allowed assets in 2018, dealers scrambled to lobby Washington to reinstate it. When they failed, they feared the market would crash.

Auctioneer Henry Highley presides over the Phillips London contemporary art evening sale in March 2023. Courtesy of Phillips.

It didn’t. Collectors simply shifted gears to capitalize on another economic advantage: low interest rates. Instead of selling the art and paying the tax, savvy buyers borrowed against their collections, because low rates meant that it cost them almost nothing. Art lending expanded dramatically. The loan book at Bank of America, one of the major players in this segment, saw 250 percent growth in the past decade, according to a representative.

But money is no longer free. And those highly leveraged individuals are now facing debt service that’s gone from, say, 2 percent to 7 percent, according to Deborah Larrison, a national art credit executive at Bank of America. In other words, it costs three times more than it did even a year ago to borrow the same amount. Add to that the ongoing turbulence in financial markets, not to mention the war in Ukraine, tech layoffs, continued inflation, and the commercial real estate doldrums, and you land in… the buyer’s market.

What’s Going on Behind the Curtain

The full extent of the reset isn’t yet clear, partly because art businesses use various strategies to obscure what’s really going on. For example, many works were withdrawn from May auctions at the last minute—some while the sales were already in progress, a popular new tactic. “It used to be a big deal, it’s no longer a big deal,” Engelen said. “It’s protecting the seller, protecting the artist’s market.”

Take Sotheby’s, where just two withdrawn lots (a Yoshitomo Nara estimated at $12 million to $18 million and a Wade Guyton painting with a $1.2 million low estimate) accounted for almost one-third of “The Now” auction’s low estimate.

“The sales would look tougher if we didn’t withdraw,” Engelen noted.

By the time June rolled in, buyers had begun making low-ball offers on the secondary market. Often, sellers weren’t desperate enough to take them, advisors and dealers said. On the primary market, a slew of galleries started reaching out to advisors and collectors to offer works by artists who until recently had waiting lists.

Phillips Asia Chairman Jonathan Crockett sells Yoshitomo Nara’s Lookin’ for a Treasure during the inaugural auction in Phillips’s new Asia headquarters. Courtesy of Phillips.

“Sometimes in a good market, a person is asking $18 million and when you offer them $16 million, they spit at you,” one advisor said. “Today, they will pay attention to you. This is the buyer’s market.”

In June, Art Basel, the art market’s most prestigious fair, offered a mixed picture. Some owners went for serious markups: Hauser & Wirth offered a wall-mounted spider sculpture by Louise Bourgeois for $22.5 million, up 37 percent from what it fetched at Sotheby’s in April 2022. Landau Fine Art was asking $25 million for a Picasso that had sold for $9.9 million in November. Others took a more cautious tack. Jeffrey Deitch offered a Warhol Mao portrait at the fair on behalf of a client for $10 million, down 31 percent from its purchase price of $14.5 million at Sotheby’s in 2018. “People are not willing to just say, ‘I don’t care what price it is, I am getting it,’” said Marc Glimcher, the CEO of Pace Gallery. “It’s a time for rational pricing and fresh material.”

The Best… or a Bargain

The current reset may dissuade speculators who have entered the market in recent years from gambling on fast, outsize returns, experts say.

“I keep hearing ‘opportunity costs, opportunity costs,’” one major art advisor said. The phrase refers to what collector-investors are not buying when they choose to buy an artwork, which doesn’t yield any interest or dividends. With the same money, they could buy stock in Meta, a share of a private company, or a U.S. treasury bond.

“That is causing people to be a little more cautious,” said a senior executive of a major art business. “They say, ‘I’m going to buy a painting that I really, really need at this moment’ rather than ‘Let me get a big exposure to art.’”

There are plenty of “opportunity cost” conversations taking place within the art space, too. “When someone wants me to buy a Mark Bradford for $7 million primary, look what else I can get for that price,” the major advisor said. “I can get great things. I can buy a great Picasso work on paper. I can buy something made 50 years ago that stood the test of time in categories that take us in a whole new direction.”

As liquidity dries up, the pendulum is starting to swing back from untested hot names toward tried-and-true blue-chip fare. The clients of the Fine Art Group are looking for classics, according to Hoffman.

With prices for ultra-contemporary works less likely to shatter estimates, smart money is investing in historical, but still comparatively affordable, work. During Christie’s day sale of the Fineberg trove, newly rediscovered market darling Lynne Drexler’s Summer Blossom (1962) fetched $1.4 million, obliterating its $200,000 high estimate, while Abstract Expressionist Grace Hartigan’s On Orchard Street (1957) generated $1.2 million, 12 times the low estimate of $100,000.

“Anything uncommercial, anything out of fashion—it’s zero interest,” Hoffman said. “The wrong Picasso, the wrong Magritte, the wrong Cézanne—no interest. The right Van Gogh—huge interest. The right diamond—huge interest. The right book—huge interest. Our clients are happy to pay record prices.”

Going forward, if works are not extremely rare, of high quality, and in excellent condition, “their prices will suffer,” said art advisor Todd Levin.

To be sure, there are still in-demand artists with wait lists and sold-out shows. But there’s a growing awareness that a tremendous amount of product changed hands over the past two years.

“A lot of people are saturated,” Cromwell said.

Written by Katya Kazakina

Source: Artnet News